New Chase Disney Credit Card Designs: Superheroes

Table Of Content

To request a replacement card, choose Replace card and follow the instructions. WalletHub editorial content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any company. In addition, it is not any company’s responsibility to ensure all questions are answered. You can earn 100 Disney Rewards Dollars for each friend (up to 5) that gets approved for any Disney® Visa® Card.

I no longer want a Disney debit card. How do I switch my debit card out for a normal card?

To determine whether a balance transfer is worth it, calculate how much you would save in interest compared to how much you'd pay in transfer fees. Chase typically charges a balance transfer fee from 3% to 5% with a $5 minimum. Before you complete a balance transfer, be sure the interest you save will outweigh the fee.

Can I get custom Chase business debit card designs?

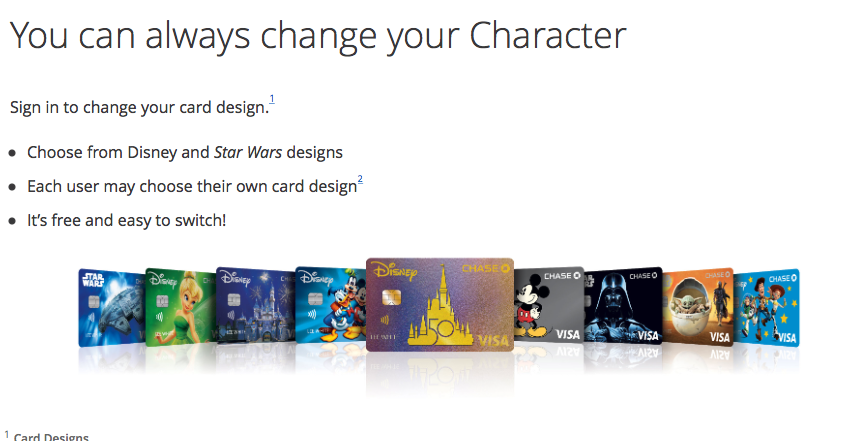

Card designs are subject to availability and may change without notice. Disney Visa Credit Cards are issued by JPMorgan Chase Bank, N.A. Member FDIC. Our suite of security features can help you protect your info, money and give you peace of mind. See how we're dedicated to helping protect you, your accounts and your loved ones from financial abuse.

Are Chase balance transfers worth it?

Cardholders with a Chase Business Checking account on their first card anniversary also receive a one-time 10% Business Relationship Bonus on eligible cash back earned in the first year. This perk can be pretty lucrative for businesses with large expenditures. While the Ink Business Cash card earns cash back, these rewards can be converted into valuable Ultimate Rewards points when paired with the Sapphire Preferred. This conversion unlocks a world of redemption possibilities, including premium travel bookings. The Bilt Mastercard earns 3X points on dining, 2X points on travel and 1X points on other purchases. By being strategic with big purchases and bill pay, you can potentially earn a lot more rewards with the Bilt Mastercard than your Sapphire Preferred.

Marriott Bonvoy Introduces New Cobrand Credit Cards From American Express And Chase Designed For People Who ... - Marriott News Center

Marriott Bonvoy Introduces New Cobrand Credit Cards From American Express And Chase Designed For People Who ....

Posted: Thu, 22 Sep 2022 07:00:00 GMT [source]

Upgrading your current Chase card to either the Sapphire Preferred or Sapphire Reserve — or upgrading from the Sapphire Preferred to the Sapphire Reserve — can be as easy as making a phone call to Chase. Upgrading is generally considered to be a product change, so it shouldn’t require a hard inquiry or a new application. However, you will need to meet the conditions for the card you’re upgrading to. For example, upgrading to the Sapphire Reserve requires an excellent credit score. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. Chase announced that several cards would begin earning extra rewards on Lyft rides.

How to complete a Chase balance transfer

Timing is everything when you are switching from one card to another. If you are moving to a card with a lower annual fee or no annual fee, make sure you change within a certain time frame to avoid paying the fee for the old card. When downgrading your card, you won’t be eligible for welcome offers. Also, before you go through with a downgrade, make sure you know what will happen with any rewards you’ve earned.

Another compelling reason to pair these two cards is their combined value proposition in terms of annual fees. While the Chase Sapphire Preferred comes with a $95 annual fee, the Freedom Unlimited has no annual fee, making it a cost-effective addition to your wallet. The Freedom Unlimited’s lack of an annual fee means you can keep it open indefinitely, helping to build a long-term relationship with Chase and improve your credit score over time with responsible use.

November 2020: Boosted grocery rewards

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. In May 2018, Chase announced three noteworthy changes to some of the signature perks on the Chase Sapphire Reserve®.

Recent Disney and Florida Attractions News Blog

Chase Sapphire Preferred® Card holders would earn 5 points per dollar spent on Lyft rides. The end date for this promotion has been extended, and it is now available through March 2025. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

Morgan offers investment education, expertise and a range of tools to help you reach your goals. Morgan Wealth Management Branch or check out our latest online investing offers, promotions, and coupons. Our valuations translate points into dollars and cents in a way that reflects reality. They are based on actual data across a balance of accessible redemption options, not just the aspirational first and business class redemptions that require a PhD in miles and points to book. The upshot is that our valuations help you understand the actual value you can easily get from your miles and points.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

This compensation may impact how and where products appear on this site, including, for example, the order in which they appear within listing categories. Other factors, such as our proprietary website's rules and the likelihood of applicants' credit approval also impact how and where products appear on the site. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards, or use our CardMatch™ tool to find cards matched to your needs. It is worth noting that personal preferences play an important part when it comes to creative credit card designs.

Her work has appeared in numerous publications, including Bankrate, Business Insider, CNN Underscored, Forbes Advisor and Lonely Planet. Aside from the balance transfer fees, the biggest downside to a balance transfer is you'll have the same amount of credit card debt as before. If you don't have a plan, or the resources, to pay off your debt before the intro APR expires, you'll be stuck paying interest once again. The process of downgrading your card begins the same way as upgrading.

You can then select any of your Chase cards from a dropdown menu and see what balance transfer offers are available. While this is a cash-back credit card, you can boost the value of the rewards you earn by pairing this card with a Chase card that allows points transfers (such as the Chase Sapphire Preferred® Card). By transferring the rewards you earn to travel partners like World Hyatt, United MileagePlus and Air Canada Aeroplan, you can potentially book luxury hotels and flights for fewer points.

Comments

Post a Comment